Life Insurance Types Life Insurance Trust

Life Insurance Types Life Insurance Trust, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

What are the benefits of an irrevocable life insurance trust.

Car insurance usa price health insurance usa cost. As well see though that extra coverage comes at a cost. Your life insurance policy is a significant asset and by putting life insurance in trust you can manage the way your beneficiaries receive their inheritance. Writing life insurance in trust is one of the best ways to protect your familys future in the event of your death.

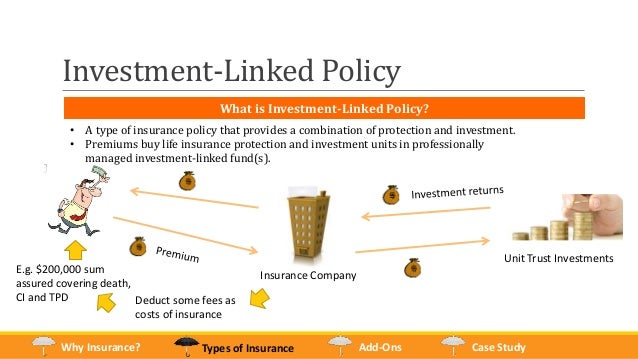

Another method to avoid estate taxes is to set up an irrevocable life insurance trust ilit. A life insurance trust has three entitiesa grantor a trustee and a beneficiary. Learn how an ilit works the types of trusts and their pros and cons to determine whether its a suitable vehicle for your assets.

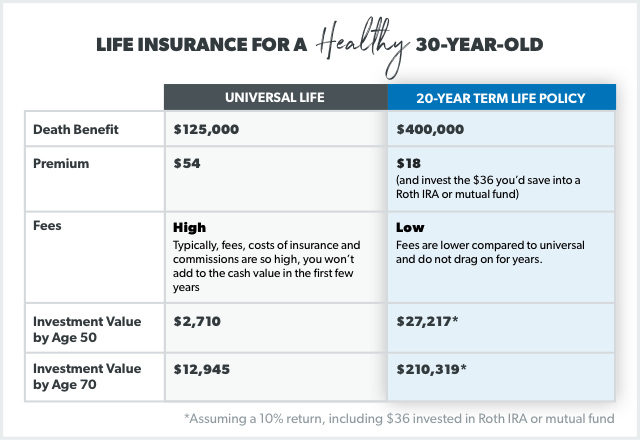

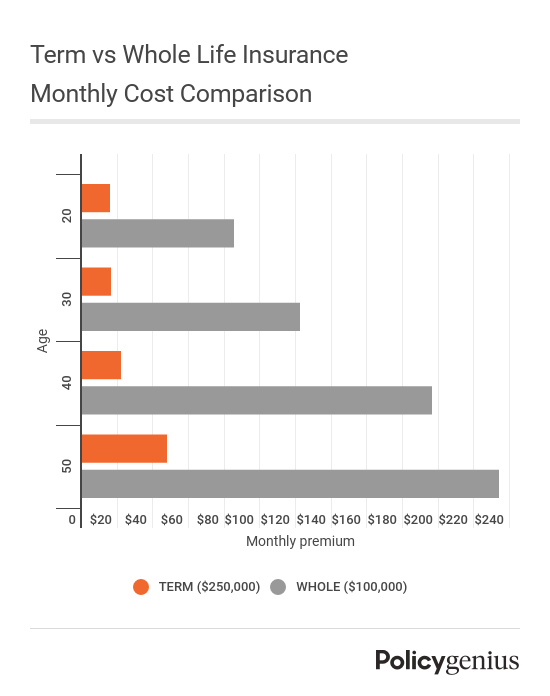

The two main types of life insurance are term and whole life insurance. Fortunately most of the agents out there do in fact have their clients best interest in mind when they make a recommendation to purchase a. A life insurance trust is an irrevocable non amendable trust which is both the owner and beneficiary of one or more life insurance policies.

This money is not subject to income tax or capital gains tax so in most cases your family will receive the money in its entirety. An irrevocable life insurance trust or ilit is a trust that can legally own a life insurance policy on a grantor and which the grantor cannot amend or revoke once it has been established. There are three types of life insurance.

Upon the death of the insured the trustee invests the insurance proceeds and administers the trust for one or more beneficiaries. Term life insurance whole of life insurance and family income benefit insurance which all pay out in slightly different ways. The beneficiary is the person to whom the proceeds of the policy will go after the death of the insured.

Whole life insurance is the simplest type of permanent life insurance. Some types of life insurance come with a cash value amount that works like savings or an investment account. For people new to life insurance the information surrounding buying a life insurance policy can all be very confusing.

The grantor is the person whose life is insured. The trustee is the person managing the life insurance trust and paying the premiums on the policy. Term life insurance is the simplest and most affordable option for most.

A trust is simply a document that specifies how a sum of money will be handled by giving control of the money to someone other than the beneficiary.